Choosing the Right Investments

Ngayon na may kaalaman ka na sa basics of investing, punta na tayo sa types of investments at mga factors na

kailangan mo i-consider. Bilang newbie investor, maaari kang malito sa mga different options ng investments.

Dahil doon, bibigyan ka namin ng tips na makakatulong sa’yo pumili ng tamang investments.

Maraming investment products mula sa banks at financial institutions. As a beginner, pwede ka magsimula gamit

ang mga financial instruments na ito:

Investment Funds

Ang Investment Funds ay pooled investments galing sa iba’t-ibang investors. May professional fund

manager na maghahandle at mag-iinvest sa iba’t-ibang financial instruments para sayo.

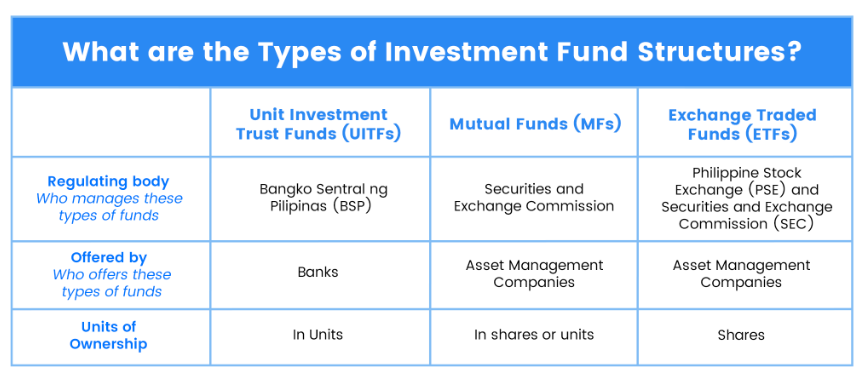

May tatlong uri ng investment fund structures: Mutual Funds, Unit Investment Trust Funds (UITFs), and Exchange

Traded Funds (ETFs).

- Ang Mutual Funds ay regulated ng Securities and Exchange Commission (SEC) kung saan binibili ng investors ang shares ng isang mutual fund company.

- Ang Unit Investment Trust Funds (UITFs) ay regulated ng Bangko Sentral ng Pilipinas (BSP) kung saan binibili ng mga investors ang units ng UITF from a bank or a trust company.

- Ang Exchange Traded Funds (ETFs) ay regulated ng Philippines Stock Exchange (PSE) and the Securities and Exchange Commission (SEC). Dito, binibili ng investors ang shares ng isang asset management company through the stock market.

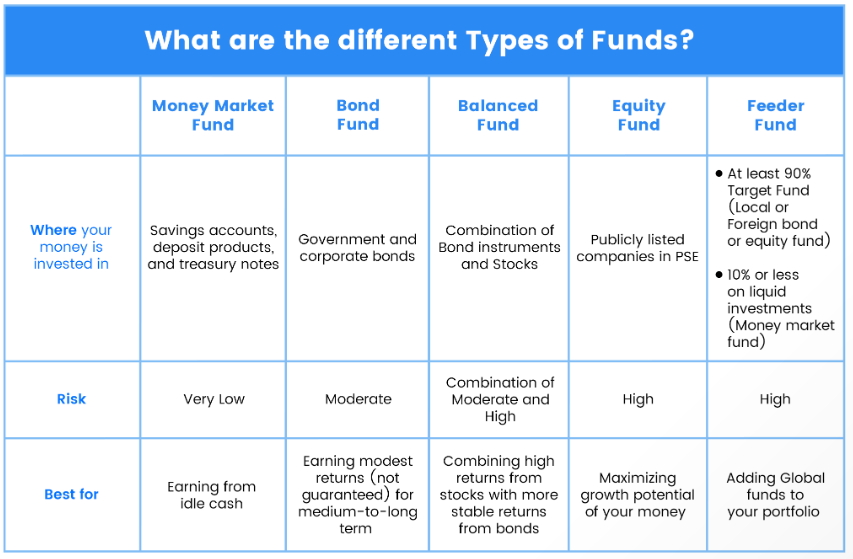

Sa market naman may limang uri ng investment funds na available

- Money Market funds

- Bond funds

- Balanced funds

- Equity funds

- Feeder funds

Bonds

Ang Bonds ay uri ng investment kung saan nagpapahiram ka ng pera sa gobyerno o isang kompanya kapalit ng fixed

regular interest payments or coupons.

May dalawang uri ng bonds: Corporate Bonds and Government Bonds.

- Ang Corporate Bonds ay issued ng private companies na nakaregister sa Securities and Exchange Commission. Private companies issue bonds para mag-raise ng money for the business.

- Ang Government Bonds ay issued ng government to raise money for projects at expansions. Ito ay low risk dahil malabo na hindi matupad ng gobyerno ang mga required payments nila.

- Isang halimbawa ng Government Bonds ay ang Retail Treasury Bonds (RTBs). These are fixed-income, peso-denominated, and short-term to medium-term debt securities issued by the Republic of the Philippines through the Bureau of the Treasury. The RTBs are part of the government's savings mobilization program designed to make government securities available to retail investors

- Why Invest in RTBs?

- RTBs provide investors a tool to diversify their investment portfolio.

- RTBs will also be offered at a small minimum investment amount of only PHP 5,000.

- Access to RTBs will be much easier as these will be available through the BTR's Online Ordering Facility and other applications.

Tip: Para kumita sa bond market, pwede ka bumili muna, i-hold ito, at hayaang mag-collect ng interest. Ito ay paid semi-annually or quarterly, depende sa bond. Pwede ka rin magka-tubo sa pamamagitan ng pagbebenta nito sa mas mataas na presyo kaysa sa pagbili mo.

Stocks

Ang stocks naman ay representation ng small portion ng isang company. Mabibili at mabebenta ito sa stock

market. High-risk ang stocks dahil pabago-bago at unpredictable ang kanilang presyo sa maikling panahon.

Pwedeng bumaba ang investments mo sa stocks kapag nag-invest ka sa companies that perform badly. Pero, if

these companies grow, tataas rin ang kanilang value.

Ang kita sa stock market ay sa pamamagitan ng dividends at capital or price appreciation.

Ang Philippine Stock Exchange (PSE) ang namamahala sa Philippine Stock Market. Kapag ikaw ay bumili o

nag-invest sa stocks, ikaw ay magiging part owner o shareholder ng isang corporation.

Kailangan mo ng isang stock broker para bumili at magbenta ng stocks. Ito ay isang tao o kompanya na

accredited ng Philippine Stock Exchange at Securities and Exchange Commission na magbenta at bumili ng stocks

on behalf of investors.

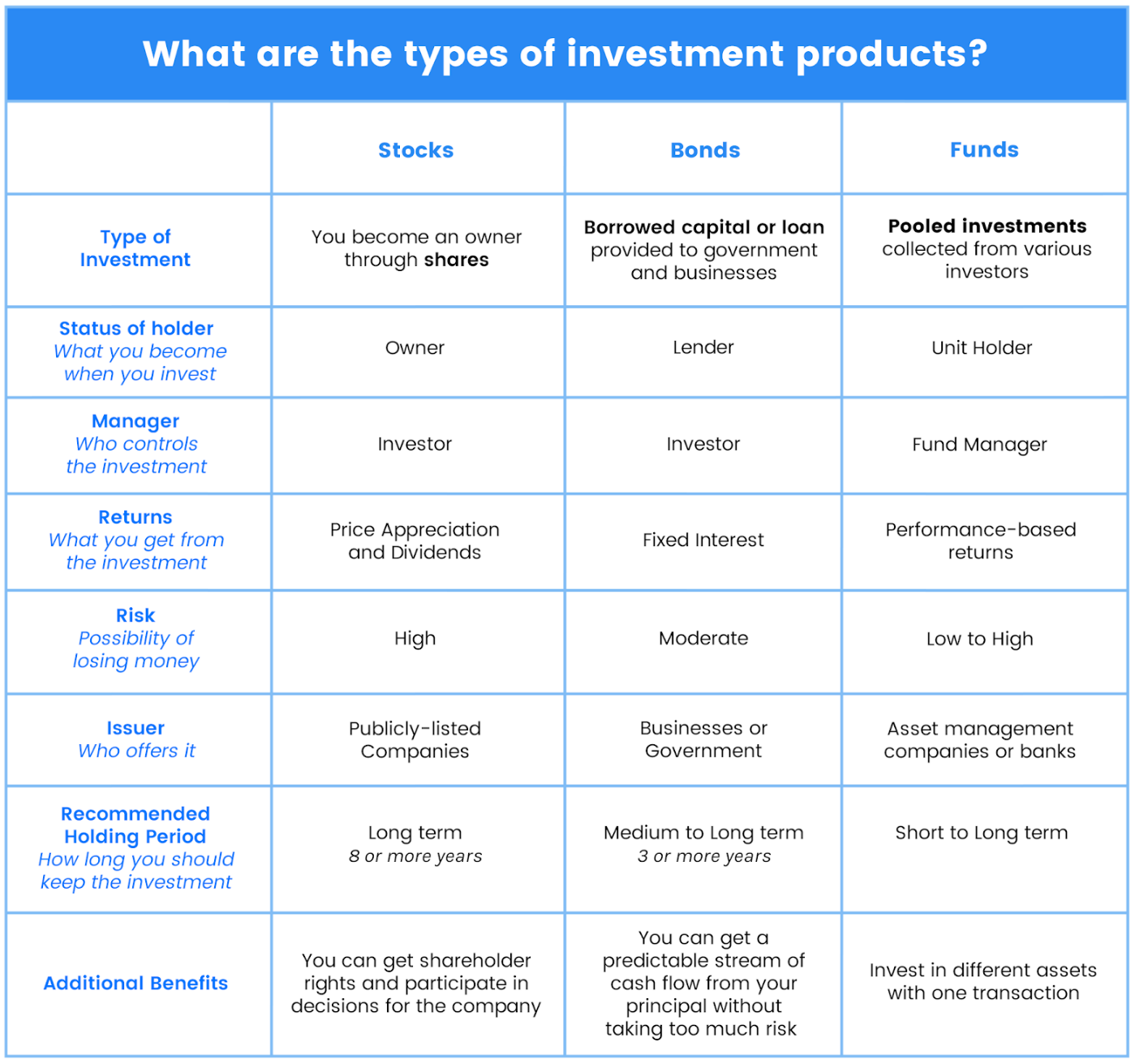

Bilang summary sa types of investment products:

Investment Tip: Mag-invest sa iba’t ibang types of products para kapag bumaba ang value ng isang investment, hopefully ay

tataas o mare-retain lang ang value ng iba mong investments para hindi ka masyadong maapektuhan. Ito ay ang

tinatawag na diversification.

To know kung anong mix ng investments ang best para sayo, check out this

Portfolio Recommender in the FiLi App! Gamitin lang ang iyong Risk

Tolerance Score mula sa Risk Tolerance Calculator.

Topics

Brought to you by:

In coordination with: